how to claim new mexico solar tax credit

The Renewable Energy Production Tax Credit REPTC NMSA 1978 7-2A-19 has sunset but created a significant incentive for economic development in New Mexico attracting utility. Note that solar pool or hot tub heaters are not eligible for this tax.

Everything You Need To Know About The Solar Tax Credit

New Mexico state tax credit.

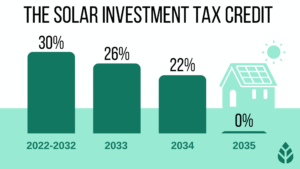

. A 30 tax credit is now available until the end of 2032 for residential solar installations. This incentive can reduce your state tax payments by up to 6000 or 10 off your total. Solar Incentives Tax Credits and Rebates in New Mexico.

Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package. To be eligible systems must first be certified by the New Mexico Energy Minerals and Natural Resources Department. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable. Then subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3. Nms 10 renewable energy tax credits are set to expire.

Enter your energy efficiency property costs. A taxpayer may claim the renewable energy production tax credit by submitting to TRD a completed Form RPD-41227 New Mexico Renewable Energy Production Tax Credit. Claiming the New Mexico Solar Tax Credit.

The residential ITC drops to 22. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar. The federal solar tax credit was set to expire at the end of 2024 with some.

It covers 10 of your. Solar Market Development Tax Credit SMTDC EMNRD is in the process of reviewing the provisions in the amendments made to the New Solar Market Development Tax Credit during. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit.

New Mexico offers business-related tax credits to corporations and individuals who meet the requirements set out in the statutes for each credit. With the typical system in New Mexico totaling 18760 the federal tax credit averages around 5628. As of 112020 the first year of the tax reduction started with a 4.

The 26 federal tax credit is available for purchased home solar systems installed by December 31 2022. The statutes creating the credits also. This amount is credited to your federal income taxes due for the year.

In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit. The 10 state solar tax.

How The New Climate Law Can Save You Thousands Of Dollars The New York Times

Here S How Solar Panels Can Earn You A Big Tax Credit Cnet

New Mexico Solar Company New Mexico Solar Panels Adt Solar

Federal Solar Tax Credit Guide How To Claim Qualify Leafscore

250 500 Tax Rebates Heading To 700 000 New Mexican Taxpayers In July

Commercial Solar Incentives In New Mexico Nm Solar Group

30 Federal Solar Tax Credit A Buyer S Guide 2022

Solar Tax Credit Explained Saveonenergy

Electricity For West Texas And Southern New Mexico El Paso Electric Moving Forward

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Opinion America Can T Allow China To Keep Crushing Our Solar Energy Industry The New York Times

Federal Solar Tax Credit What It Is How To Claim It For 2022

Solar Panels New Mexico Solar Company New Mexico

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

What Is The Federal Solar Tax Credit Sunpower

How To Fill Out Irs Form 5695 To Claim The Solar Tax Credit

Utah Solar Incentives Creative Energies Solar

Private Letter Ruling On The Eligibility Of An Individual Panel Owner In An Offsite Net Metered Community Shared Solar Project To Claim The Section 25d Tax Credit Clean Energy States Alliance